In investing, the time vs. timing argument has been going on for ages. Some will argue that timing the markets is the only intelligent way to go about investing. How else are you supposed to make big money? Others argue that the only reliable way to go about investing is to hold diversified portfolios for long periods of time. After all, we can’t predict the future.

In this article, we will explain what those terms mean and explore the arguments for both.

The Argument for Time

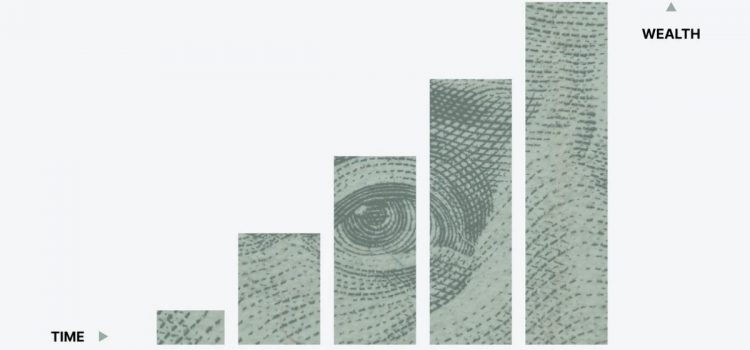

One of the most valuable assets you can have in investing is time. Especially if you don’t have other things like large amounts of money to invest or a lot of knowledge or experience in choosing investments.

Time allows your investments to compound, making for good returns in the future, even if you didn’t have much to invest at the beginning. It’s a huge advantage over starting later in life.

With a diversified portfolio, time also takes away some of the pressure of choosing just the right investments. Your choices don’t have to generate massive returns in short amounts of time, and you won’t be ruined if they drop in value. You’re not choosing one thing and hoping to get in and out at exactly the right time.

Think of your diversified portfolio as a sturdy boat. In combination with time, it allows you to ride the waves of market volatility and sail over the trend crazes, knowing that you have plenty of time to get to your destination. The rolling waves simply provide you with some nice scenery as you focus on the horizon.

What we’re remembering

Post by Josh Brown.

The Argument for Timing.

Timing the markets is the practice of trying to take advantage of all the good and avoid all the bad. The strategies vary but the general idea is to buy an investment right before it is expected to climb in value and sell it at the peak, before the value starts to fall.

Most people who try to time the markets also tend to have very concentrated portfolios, meaning they place a lot of money in one investment to make the most out of its climb. Rather than place a portion of their money in a multitude of different investments, they place a large percentage or even all their money in a single stock to maximize the gains they could make.

Timing done successfully can make you rich fast. If you get in and subsequently back out at the right times, you can potentially multiply your money by a lot in a short amount of time. Billionaires are made in this way: by making big bets.

A recent example would be those that bought into bitcoin at a low price and sold right before the price crashed. Picking the right moment requires a lot of knowledge, research, careful selection, and constant watching and evaluating.

If timing is done successfully, the potential payoff is huge.

Time VS. Timing.

After discussing the merits of each strategy, we’re stuck with the question that financial big wigs across the globe are still fighting about: which is better?

The answer seems quite obvious. If you can do it successfully, timing the market is obviously the way to go. Making big money in a short amount of time? Missing all the bad stuff and taking advantage of all the good stuff? Yes please!

However, we have this tricky little factor known as reality.

And the reality is, it’s nearly impossible to consistently time the markets. To be able to time the markets, we have to be able to predict their movements and that is something that just isn’t possible to do reliably.

To even get close, we would have to spend endless hours researching and studying the patterns, hoping that one of them repeats itself so we can exploit it. Or take a wild stab in the dark and gamble on our choices.

To most people, neither of those sound like the best strategy for their long-term savings. Thankfully, it is not our only option to build wealth.

With the benefit of time, all we have to do is pick some quality investments, diversify them, and occasionally rebalance. As Charlie Munger always says, the buy and hold strategy is for investors that don’t know what they’re doing. He is basically saying that if we want wealth without endless research and studying and hoping for the markets to do what we expected, we can simply wait.

The well-oiled machine of time and compound interest does the work while our only job is to keep our fingers out of the gears. Sometimes the machine looks old and like it could use some help. It has been around for a long time, but it has kept working. All it needs is for us not to poke it.

It’s harder than it sounds! When we hear things pop and hiss and make all manner of terrible noises, we are going to want to fix it. That’s why it’s generally best not to watch.

Leave the machine alone and we will find that, with time, it will give us the result we’re looking for.