I get a few questions from many people saving for their first home down payment: Should I save it or invest it to achieve my goal faster? And where should I save it, in an RRSP, TFSA or neither?

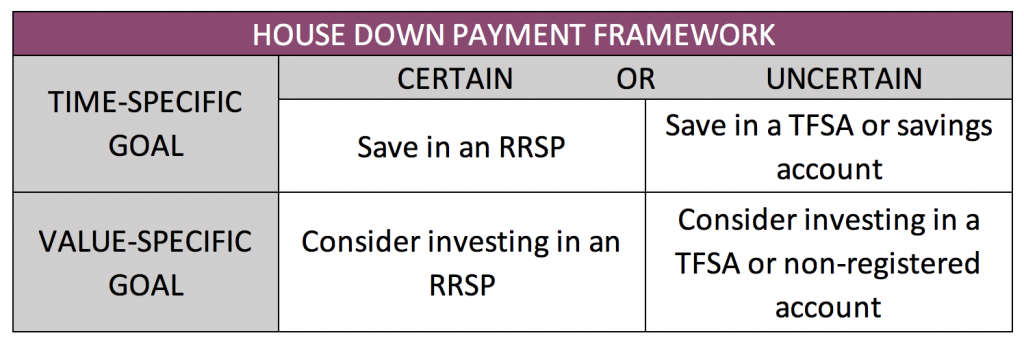

Here is a framework I have developed to think about this.

First, I would establish the nature of your goal. For example, is it time-specific, or is it value-specific?

Let me give you an example. Do you have your heart set on purchasing your first house in nine months? Your goal is time-specific because your goal is associated with a specific date.

Or is there a price point you’re striving for before you start scanning the real estate market? If so, your goal is value-specific because it’s attached to reaching a dollar value.

If your goal is time-specific and your ideal date is within the next three years, do not consider investing and save it. We don’t know if the market will be up or down in the particular month you want to buy.

Alternatively, suppose your goal is value-specific, and you’re open to the option of achieving your goal sooner with fewer savings. In that case, you can consider investing it in a portfolio of investments.

This can be a fairly bold move, so I would encourage you to connect with a trusted friend to determine if this is suitable for you.

Moving on to if you should save for your down payment within a TFSA, RRSP or neither.

Here, I would determine how much flexibility you need.

How certain are you that you want to buy a house? If you are very confident, an RRSP will get you there sooner because you save with pre-tax dollars.

If you are less convinced and want to keep your options open, I would suggest leaning toward saving for your house down payment in a TFSA or savings account.

RRSPs are more restrictive and withhold tax if you take money out for another purpose than a first home purchase.

If you would like to consider a similar decision together, please let us know. We would love to help.